What Does Ach Processing Do?

Table of ContentsNot known Facts About Ach ProcessingSome Ideas on Ach Processing You Should KnowLittle Known Facts About Ach Processing.Ach Processing Fundamentals ExplainedAch Processing Can Be Fun For AnyoneThe Greatest Guide To Ach Processing

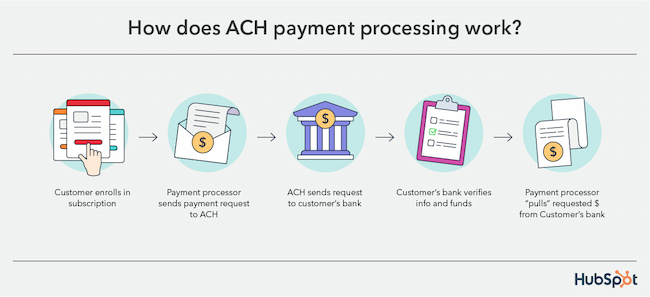

The Federal Get after that kinds all the ACH files and afterwards routes it to the receiver's bank the RDFI.The RDFI then processes the ACH documents and also credit scores the receiver's (Hyde) account with 100$. The instance over is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the exact same process takes place in opposite.The RDFI posts the return ACH file to the ACH network, along with a reason code for the mistake. A return may be refined likewise because of numerous other factors like a void account number etc. ACH payments can function as a terrific option for Saa, S services. Right here are some bottom lines to remember when selecting ACH for your Saa, S: Although the use of paper checks has actually dropped to a wonderful extent, many enterprise firms still use checks to pay each month to avoid the significant portion of handling costs.

With ACH, given that the deal handling is recurring as well as automated, you wouldn't need to await a paper check to get here. Likewise, considering that clients have authorized you to collect payments on their behalf, the adaptability of it allows you to gather single payments also. No more unpleasant e-mails asking consumers to pay up.

7 Simple Techniques For Ach Processing

Charge card repayments stop working because of different factors such as ended cards, blocked cards, transactional mistakes, and so on - ach processing. Sometimes the consumer might have gone beyond the credit rating limit which could have brought about a decline. In instance of a bank transfer using ACH, the checking account number is made use of along with a consent, to charge the client and also unlike card deals, the chance of a bank transfer falling short is very low.

Account numbers seldom alter. Additionally, unlike card purchases, financial institution transfers stop working only for a handful of reasons such as insufficient funds, wrong bank account details, and so on. Additionally, the two-level confirmation process for ACH repayments, guarantees that you maintain a touchpoint with consumers. This consider for spin as a result of unknown reasons.

The consumer initially raises a request to pay through ACH as well as then, after validating the client, ACH as a settlement alternative is allowed for the specific account. Only after that, can a customer make a straight debit payment using ACH. This verification consists of inspecting great site the legitimacy as well as authenticity of the savings account.

The Facts About Ach Processing Revealed

This secure process makes ACH a credible alternative. If you're considering ACH, head right here to recognize just how to accept ACH debit payments as an on the internet organization. For each bank card purchase, a percent of the cash involved is split throughout the numerous entities which made it possible for the payment. A major chunk look at this site of this charge is the Interchange charge.

and also is commonly approximately 2% of the complete purchase charge. In instance of a transaction transmitted by means of the ACH network, considering that it directly deals with the banking network, the interchange cost is around 0. 5-1 % of the complete deal. Right here's some quick mathematics with some basic portion rates to make points easier: Let's claim you have a venture client who pays you a yearly membership charge of $10,000.

Unknown Facts About Ach Processing

They charge high volume (more than $1000) individuals with just $30 level charge for endless ACH purchases. You can drive increased adoption of ACH payments over the long term by incentivizing consumers using rewards and also rewards.

ACH transfers are digital, bank-to-bank cash transfers refined with the Automated Cleaning House Network.

The Of Ach Processing

Straight repayments entail cash heading out of an account, including bill repayments or when you send out cash to a person else. ACH transfers are practical, quick, and also usually complimentary. ach processing. You may be restricted in the number of ACH purchases you can start, you may sustain extra costs, and there might be delays in sending/receiving funds.

7% from the previous year. Person-to-person and business-to-business deals likewise raised to 271 million (+24. ACH transfers have many uses as well as can be a lot more inexpensive and easy to use than click for more info composing checks or paying with a debt or debit card.

All about Ach Processing

ACH transfers can make life much easier for both the sender as well as recipient., or when you had to walk your bill settlement down to the electric firm prior to the due date.